Bitcoin mining shares skilled widespread declines Wednesday, with most main publicly traded companies within the sector within the purple.

Bitcoin Mining Shares See Pink Throughout the Board

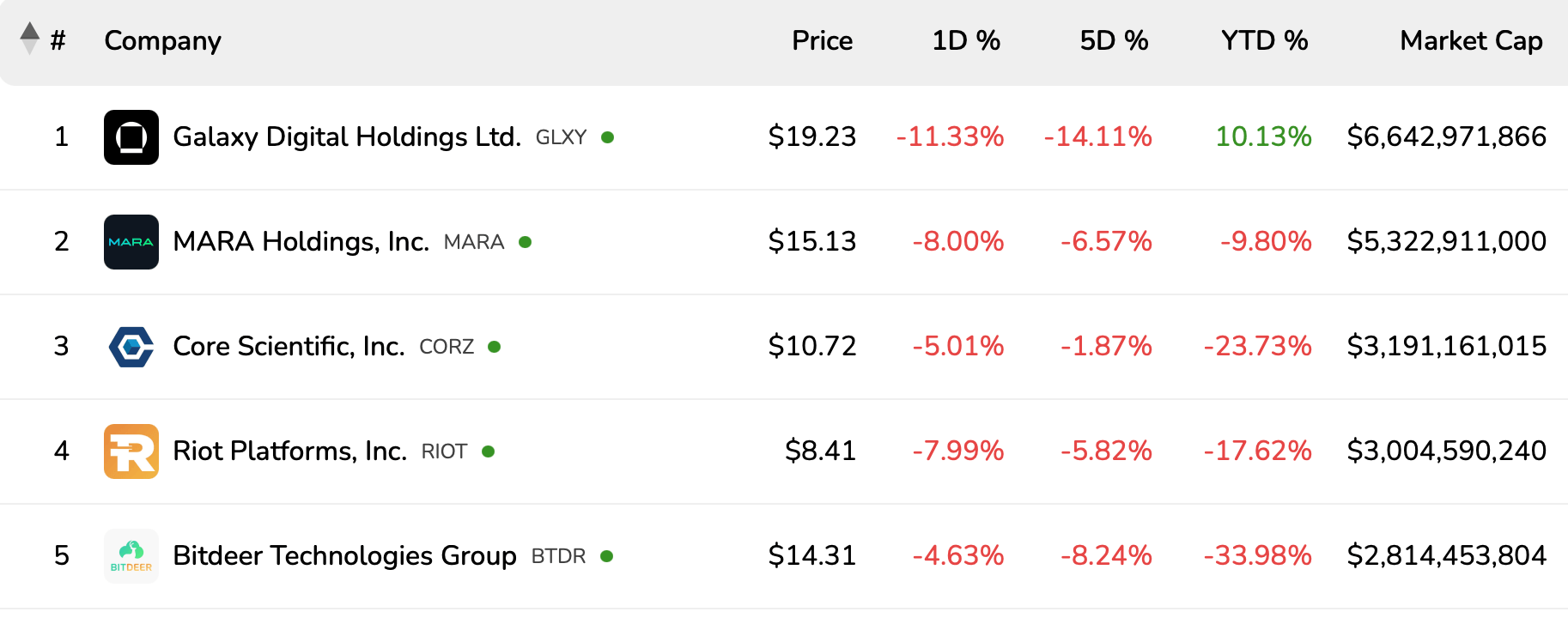

Galaxy Digital Holdings, main by market capitalization at $6.64 billion noticed its shares drop 11.33% this afternoon and 14.11% over the past 5 periods, even because it’s up 10.13% 12 months so far. The bitcoin miner MARA Holdings adopted with a $5.32 billion valuation however to date it has fallen 8% Wednesday and is down practically 10% 12 months so far.

The highest 5 publicly-listed bitcoin mining companies by market cap in keeping with bitcoinminingstock.io at 11:30 a.m. Japanese time.

Out of the highest twelve publicly-traded miners, Core Scientific, Riot Platforms, and Bitdeer Applied sciences all posted vital one-day losses of greater than 4%, with year-to-date figures exhibiting deeper declines. Bitdeer is now down practically 34% on the 12 months, whereas Riot has slipped 17.62%, and Core Scientific is down 23.73%.

Just a few companies posted beneficial properties over the previous 5 periods. Northern Knowledge AG was the standout, leaping 9% right now and 12.52% over the past week. Regardless of these short-term beneficial properties, it stays the largest year-to-date laggard on the record, down 35.81% in opposition to the U.S. greenback.

Cleanspark held regular with a marginal 0.02% achieve 12 months so far, regardless of dropping 6.57% throughout right now’s buying and selling session. IREN Restricted posted a small five-day achieve of 1.45%, however its year-to-date efficiency stays within the unfavourable.

The smallest firms by market capitalization, Terawulf, and Cipher Mining, continued to commerce beneath $4 per share and remained sharply unfavourable 12 months so far, down greater than 28% and 34%, respectively.

The uneven efficiency throughout bitcoin mining shares suggests a market grappling with value pressures. Brief-term rallies from choose companies trace at speculative shopping for, however sustained losses elsewhere mirror broader doubts about profitability and development.

As volatility persists, traders could also be weighing operational effectivity and capital power extra closely than easy publicity to the bitcoin mining sector’s market motion.