Bitcoin worth has entered a shaky section because it hovers close to $105,000, with its current bullish momentum starting to weaken beneath mounting macroeconomic stress. The BTC worth charts are flashing early indicators of a possible downtrend, and if the cracks widen, a correction to $90,000 will not be out of the query. Let’s dig into the technicals, current developments, and key worth ranges.

Bitcoin Value Prediction: Why is Bitcoin Dropping Momentum Close to $110,000?

BTC/USD 1 Day Chart- TradingView

On the every day chart, BTC worth just lately struggled to carry above the R3 pivot zone close to $110,000. After reaching a neighborhood excessive slightly below this stage, sellers took management, driving the worth all the way down to $105,000. Notably, the Heikin Ashi candles present three consecutive purple bars forming close to a key Fibonacci pivot zone (0.786), which frequently indicators a lack of bullish steam.

Furthermore, the Bitcoin worth is beginning to flatten out close to the 20-day shifting common ($106,172). A clear break under this might set off additional draw back to the 50-day SMA at $97,506 — a area that beforehand acted as consolidation help in April.

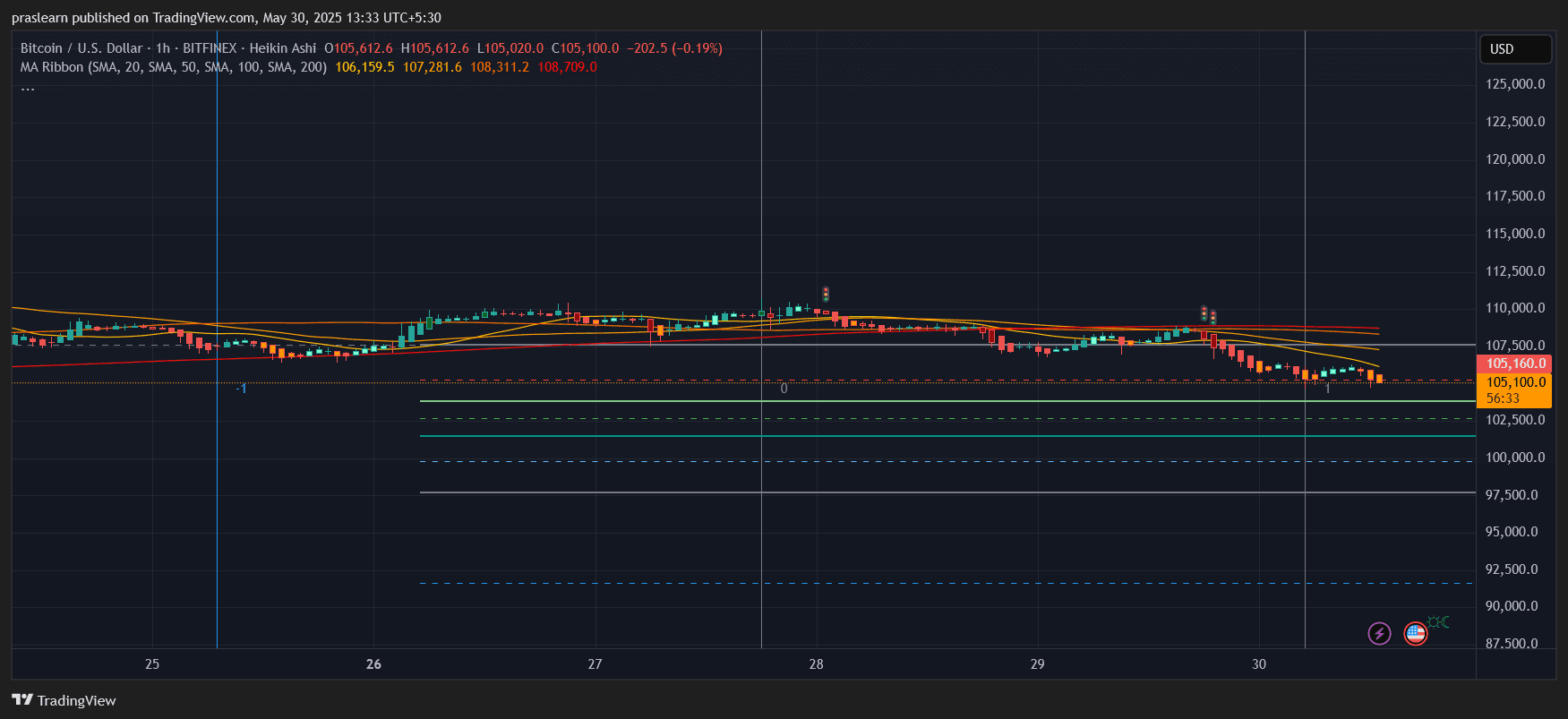

Hourly Chart Confirms Bearish Strain Constructing

BTC/USD 1 Hr Chart- TradingView

The hourly chart offers extra speedy indicators of weak spot. BTC worth has been rejected a number of instances close to the 50-SMA ($107,281) and 100-SMA ($108,311), with clear decrease highs forming. This construction, coupled with flat quantity and a bearish alignment of the MA ribbon (20 < 50 < 100 < 200), means that short-term merchants are dropping confidence.

Bitcoin worth tried to reclaim $106K however was rapidly pushed again, and the worth is now hovering simply above essential intraday help at $105K. If this zone breaks decisively, the following hourly help rests round $102,000.

What Might Set off a Bitcoin Value Crash to $90,000?

Let’s break down a number of key drivers that would escalate this correction:

1. Macroeconomic Instability:

Ongoing US–China commerce tensions have resurfaced after commerce talks stalled. Add to that the US courtroom blocking key tariffs, which raises questions on future commerce enforcement. This has created a local weather of uncertainty — typically bearish for high-risk property like crypto.

2. Weak US Financial Knowledge:

A shock contraction of 0.2% in US GDP for Q1 2025 and a spike in jobless claims have spooked traders. Sometimes, such information results in a shift towards safer property, and Bitcoin, regardless of its long-term attraction, typically takes a success throughout speedy liquidity crunches.

3. Technical Breakdown Danger:

From the chart, a break under $105,000 (present help) opens the door to check the 0.618 Fibonacci stage round $97,000. A failure to bounce right here will increase the danger of sliding all the way down to $90,000 — the 0.236 stage on the pivot scale and a serious earlier resistance that would now act as help.

Let’s run a fast Fibonacci-based state of affairs:

- Current swing excessive: $111,800

- Swing low: $88,500

- 0.236 stage = $93,730

- 0.618 stage = $100,156

If $105,000 breaks and $97,000 fails, the following probably space of help sits at round $93,730 – $90,000, aligning with historic accumulation zones.

Will Bitcoin Bulls Step In?

Whereas long-term traders might even see $90K as a dip-buying alternative, short-term merchants are watching intently for any signal of a breakdown under the 20-day shifting common. The 200-day SMA stays far under at $94,646 — a line within the sand that, if damaged, might set off institutional outflows.

For now, bulls should reclaim $107,000 to renew upside, however the odds appear to favor bears until macroeconomic headwinds ease.

Bitcoin Value Prediction: Can It Rebound or Will Bitcoin Value Crash to $90,000?

Given the present technical setup and exterior stress, a correction to the $97,000–$90,000 vary is more and more probably within the subsequent 1–2 weeks until Bitcoin worth reclaims $107,500 rapidly and flips it into sturdy help.

Merchants ought to watch:

- $105,000 as speedy help

- $107,500 as reclaim stage for bullish continuation

- $97,000–$94,000 as key draw back Fibonacci targets

- $90,000 as main help from pivot and historic demand zone

If the macro panorama worsens additional — say a drop in S&P 500 or oil shocks — BTC might check even $88,000 ranges briefly earlier than a bounce.

Remaining Take: Bearish Bias Till Confirmed In any other case

Bitcoin worth failure to carry above the pivot R3 zone, mixed with weakening shifting averages and rising financial uncertainty, factors to a cautious short-term outlook. Merchants eyeing leverage ought to put together for volatility, whereas long-term holders might quickly get one other golden entry — presumably close to $90,000. Till then, Bitcoin stays on watch.

$BTC, $Bitcoin